-

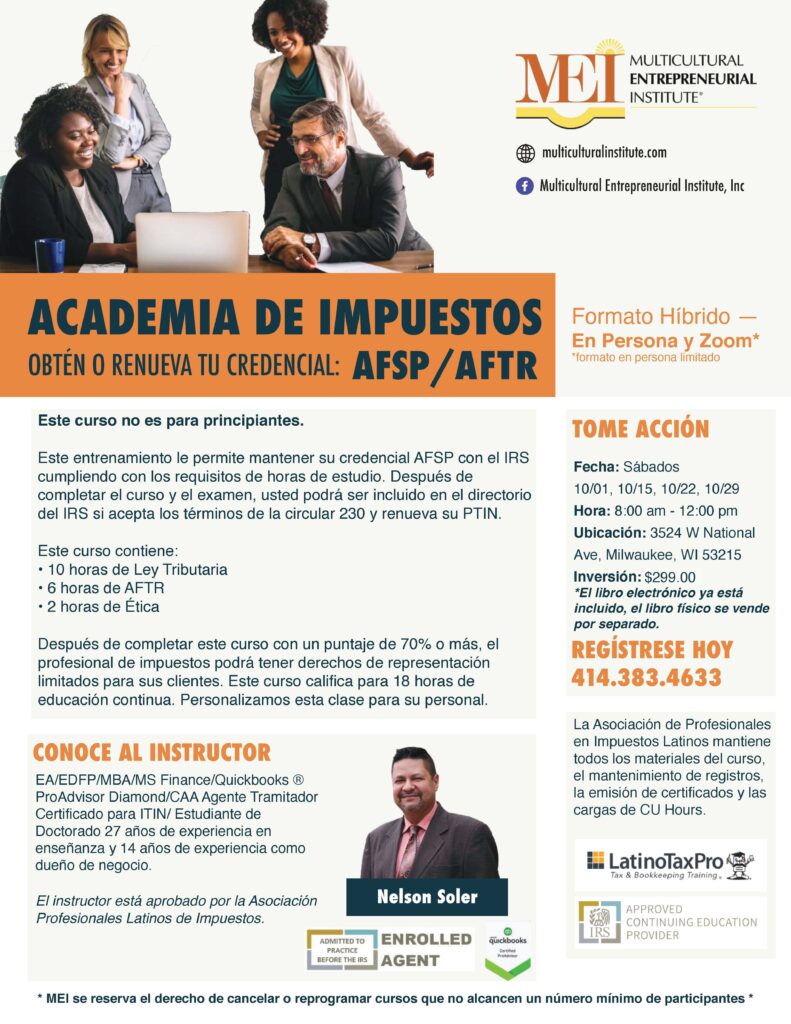

Tax Academy AFTR/AFSP$299.00

Tax Academy AFTR/AFSP$299.00

Are you an unenrolled tax preparer? Don’t lose your representation rights! Complete this annual voluntary requirement to be included in the IRS national database by December 31, renew your PTIN and consent to Circular 230.

Our classes are designed to teach you the necessary skills to change your future and increase your revenue.

- Flexible Class Schedule

- Experienced Instructor

- Convenient Location

- Affordable Tuition

- Our classes are designed to teach you the necessary skills to change your future and increase your revenue.

We offer two primary courses in a blended in class/online format that would allow you to receive the CEU’s required to attain your annual ASFP designation:

Tax Preparation Course – for individuals who have never done taxes

Annual Filing Season Program Course – Tax review course for your annual credential renewal

Take Action

Saturday’s

10/01, 10/15, 10/22, 10/29

8 AM – 12 PM

Location

5 Wise Workshop: 3524 W National Ave Milwaukee, WI 53215

Investment

General Public: $299

*eBook already included, physical book sold separately.*

Call us for more information at 414-383-4633. We can take the training to your organization if you have 8 or more individuals interested.